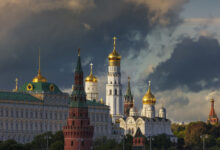

The energy-dependent German economy has been in decline since losing cheap Russian oil and gas

© Getty Images / picture alliance / Contributor

The German economy, once Europe’s roaring engine of growth, slipped into recession in early 2023 amid runaway inflation, the national statistics office revealed this week. GDP data is reportedly showing surprisingly negative signals, with the economy losing the potential for growth. RT looks at the challenges facing the EU’s economic powerhouse.

- Why is Germany’s recession important?

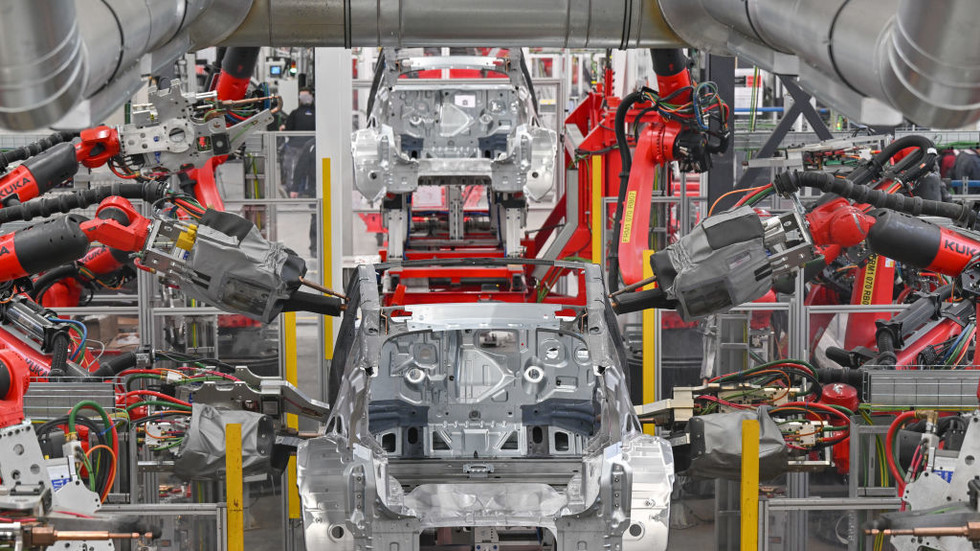

The EU’s largest and richest member, Germany has built its economic power on its manufacturing capacity, its integration into international trade, and a strong transport and logistics ecosystem. It is the world’s fourth-largest economy, behind the US, China, and Japan. - What is crippling the EU’s economic titan?

Post-pandemic supply-chain problems and trade disputes, along with the energy crisis and aggressive monetary policy tightening, have all placed a strain on the export-oriented German economy. Industrial production has stalled amid geopolitical tensions, supply bottlenecks, and a shift to green energy. That was followed by a drop in purchasing power and diminished industrial orders. - What’s the major challenge for Berlin?

The most important issue for the government is to sustainably serve the energy needs of the country’s industrial base amid the green transition. Germany is one of the world’s leading industrial nations and manufacturing accounts for about a fifth of the economy, which for decades relied on cheap Russian energy to grow. - What has the impact been of sanctions and the energy crisis?

Among EU members, Germany has been the hardest hit by the side effects of Western sanctions on Russia, as flows of Russian natural gas have dwindled significantly. The sabotage on the Nord Stream pipeline, one of the main routes for Russian gas to Europe, has added to the woes. As a result, Germany no longer receives gas directly from Russia, having previously imported more than 50% of its blue fuel from the country. Meanwhile, European wholesale energy prices reached unprecedented levels in 2022 as a result of sanctions on Russia, prompting fears of deindustrialization, particularly in Germany. - What other risks threaten Europe’s leading economy?

As a hub for industry, Germany is facing huge technological and political challenges. A lack of qualified workers is another major problem, forcing Berlin to further liberalize immigration. A recent study by the German Economy Institute showed that industries had more than 630,000 open vacancies for qualified workers they could not fill in 2022, up from 280,000 a year before. - Is the EU’s green energy push helpful?

German manufacturers have been struggling to produce cars and factory equipment because of parts and labor shortages, as well as surging energy prices. Moreover, they are being forced to invest hundreds of billions of euros over the coming years to meet the bloc’s new clean-energy standards. The nation’s automotive industry, by far the biggest in Europe, used to support hundreds of thousands German jobs and account for over 20% of the nation’s overall economic output. However, demand for German cars has been in decline amid the global shift toward electric vehicles. - Could German industry grind to a halt?

Economists are predicting that the industrial sector, which has been the pillar of the German economy, will remain stagnant this year instead of the hoped-for recovery, dampening the prospects of an economic resurgence. The outlook is grim as the transition to affordable renewable power could still take years, experts claim. - Is the EU’s powerhouse breaking down?

The German economy, formerly a reliable engine for pulling the European Union out of crises, has turned into its weak link. Economists see German growth lagging behind the rest of the region for years to come, while the International Monetary Fund has forecast it will be the worst-performing G7 economy this year.

For more stories on economy & finance visit RT’s business section