Roughly half of Russia’s $640 billion of gold and forex assets held abroad were frozen by Western central banks last March

© Getty Images / KTSDESIGN/SCIENCE PHOTO LIBRARY

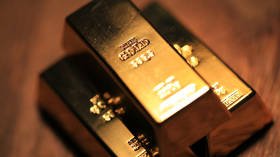

An increasing number of countries are bringing home their bullion reserves in the wake of unprecedented sanctions imposed by the West on Russia, Reuters reported on Monday, citing an Invesco survey of central bank and sovereign wealth funds.

According to the report, widespread losses for sovereign money managers resulting from last year’s financial market rout made them “fundamentally” rethink their strategies amid fears of higher inflation and further geopolitical tensions.

The survey showed that over 85% of the participating 85 sovereign wealth funds and 57 central banks believe that inflation will now be higher in the coming decade than in the last.

A “substantial share” of central banks were reportedly concerned by the precedent set by sanctions on Russia. Almost 60% of respondents said it had made gold more attractive, while 68% were keeping reserves at home, compared with 50% in 2020.

“’If it’s my gold then I want it in my country’ (has) been the mantra we have seen in the last year or so,” according to Invesco’s head of official institutions, Rod Ringrow, who oversaw the report.

Confirming Ringrow’s assessment, one central bank told Reuters anonymously: “We did have it (gold) held in London… but now we’ve transferred it back to [our] own country to hold as a safe haven asset and to keep it safe.”

Nearly half of Russia’s $640 billion worth of gold and forex reserves were frozen by the West last year, included in numerous rounds of sanctions over the conflict in Ukraine. Moscow has condemned the freezing of its assets, describing the West’s plans to expropriate those funds as theft and warning of retaliatory measures.

The Ivesco study showed that geopolitical concerns, combined with opportunities in emerging markets, have also triggered a shift among some central banks away from the US dollar. Of those surveyed, 7% reportedly believe that mounting US debt is also negative for the greenback, but most still see no alternative to the dollar as the world’s reserve currency.

For more stories on economy & finance visit RT’s business section